Survey, shopping, and social media

So I did me a little survey the other day, to inform some of the thinking around an idea I've been noodling with. Basically, I wanted to find out whether people feel in control of their shopping spend, and whether they think it's important to be. I wanted to find out whether there's a real problem worth tackling here.

I prepared a really quick Google Form, and fired it in quite a few directions:

- Twitter (where I have 1570 followers, and 15 people retweeted it to a total of 45,961 more followers, not accounting for overlaps between social circles);

- Facebook (342 friends);

- Google+ as a public post (388 people have me in their circles);

- A university forum run by TheStudentRoom;

- The Skiff Mates mailing list (which I think has a couple of hundred members).

I had each posting send its answers to a different Google spreadsheet, so I could compare audiences (particularly the student and Skiff ones, as these wouldn't be based on people I know) without asking individuals to answer one of those "where did you hear about this survey" questions.

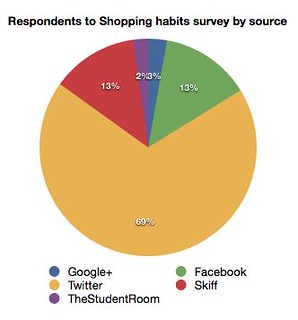

The first thing I noted was the number of responses. I had 179 in total, here's how they broke down between those sources:

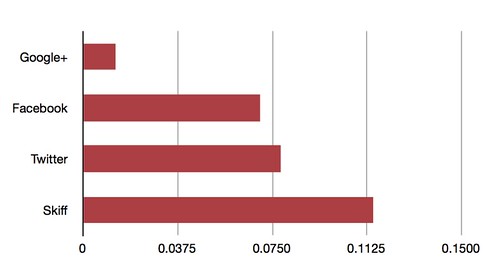

And here's how many responses I got, per person I sent this to directly (i.e. not counting those retweeters):

So just looking at the quantity of responses: Twitter is fantastic for delivering numbers, but my audience on Facebook seem just as inclined to join in. The Skiff mailing list has a pile of really helpful folks (which isn't a total surprise to anyone who's been there). Google+ delivered very little traffic, which was a bit of a surprise; I've found it a great place to get into discussions around posts and tend to get more comments there than on my blog.

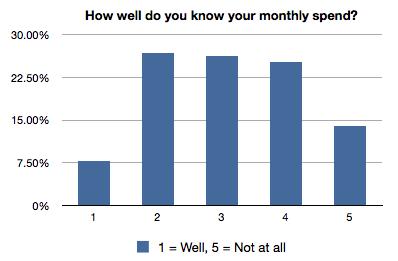

Onto the content; few know what they spend really well, there's a sizeable minority of 14% who don't have a clue, and about 40% of people have general poor understanding:

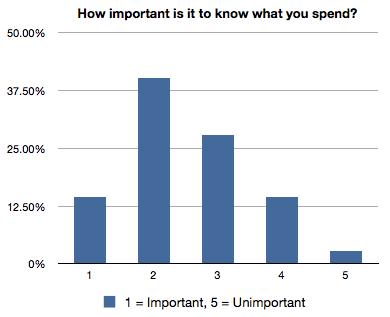

In contrast, respondents tended to feel it was important. 15% felt it was extremely important, 55% fairly important or better:

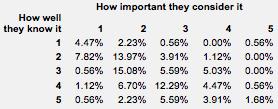

The interesting stuff came when I compared the two audiences, to find, say, people who understand their own shopping poorly but think it's important. (Please excuse the graphical table)

If I worked in advertising, I would probably give the segments in this table catchy names. But I don't, so I won't. Conclusions from this:

- Most people who consider understanding their shopping to be important think they understand it already: 28.5% of the audience answered both questions with 1 or 2;

- There's a small minority - just over 10% - who consider self-knowledge about shopping important, and admit they don't know their own habits well. These sound like my prospective audience;

- 17.3% just don't think it's important (answering 4 or 5), and 10.61% neither know nor care (answering 4 or 5 to both questions);

- Between these groups there's an interesting little float of groups: 23.5% who think it's of average (3) importance but don't know (4 or more), and 15.5% who know it reasonably well (3 or better) but consider it important (2 or better).

Two final points: about half of the respondents (94 out of 179) were kind enough to give me their email addresses (9 of whom fit in my prospective audience, and may hear from me), and 96.6% of them say they own smartphones. This last point suggests my surveyed sample is biased towards smartphone owners.

Spending a year in academia is giving me an appreciation for experiment design and Doing Things Properly. So in a bid to be a bit more rigorous, I had a think about what I would want to see from the survey results in order to find them interesting, before I sent it out.

I wanted 100 respondents; 30%+ to answer 3 or higher on the "how well do you understand" question (65% did); 30% to answer 2 or lower on the "how important is it" question (54% did); and 10% of respondents to answer 4 or 5 to the former, and 1 or 2 to the latter, and have a smartphone (10.61% did). I think this experiment confirms my hypothesis that there's a latent demand for help here from a sizeable audience.